Cash flows are fundamentally important for an organisation’s wellbeing and survival. This article explains the accruals accounting and “indirect” cash flow presentations that can cause confusion.

As treasurers we need to:

1. Build a solid understanding of the purpose of accruals accounting.

2. Appreciate alternative cash flow presentations.

3. “Reverse out” accounting adjustments with confidence.

Among other things, “accruals” can refer to the accounting principle of matching, or to accrued (accelerated) expenses. Other examples of accruals include pensions.

1. Purpose of accruals accounting (matching)

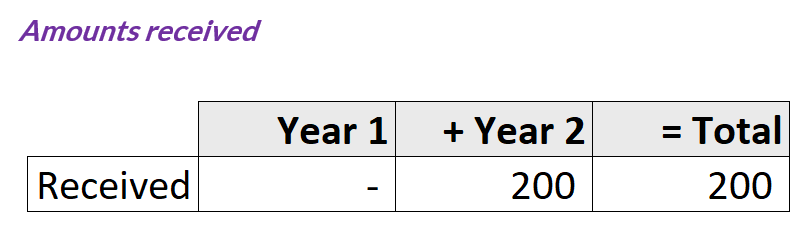

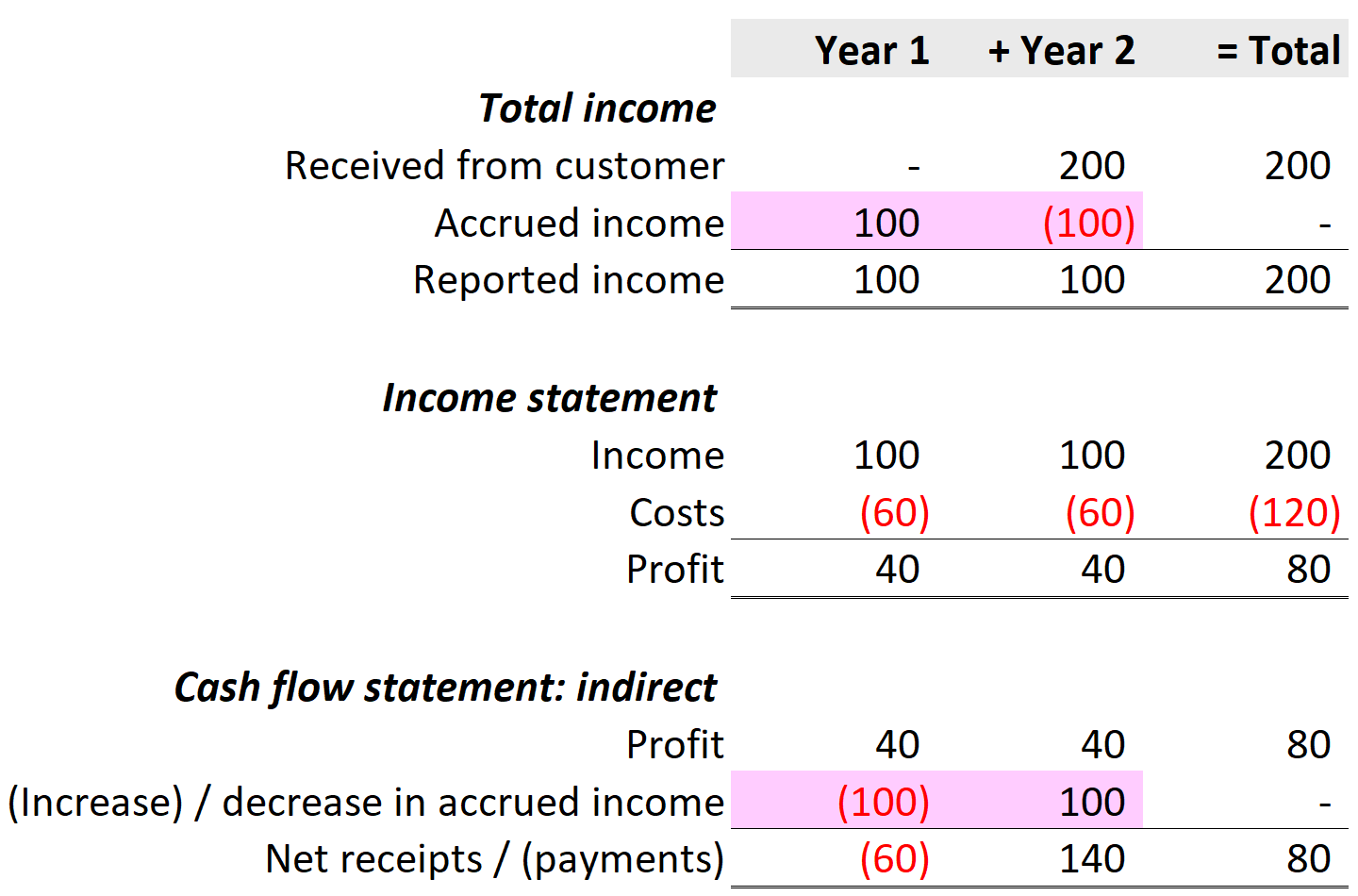

Let’s say we run a simple business with a single customer. We enjoy an income of 100 per year for services provided to our customer month by month. In a forecast two-year period, the customer pays us a lump sum of 200 in the second year, covering all of our services for the entire two-year period.

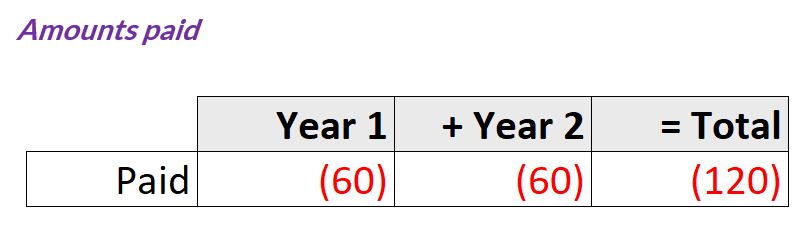

Our costs are 60 per year, all paid during the year.

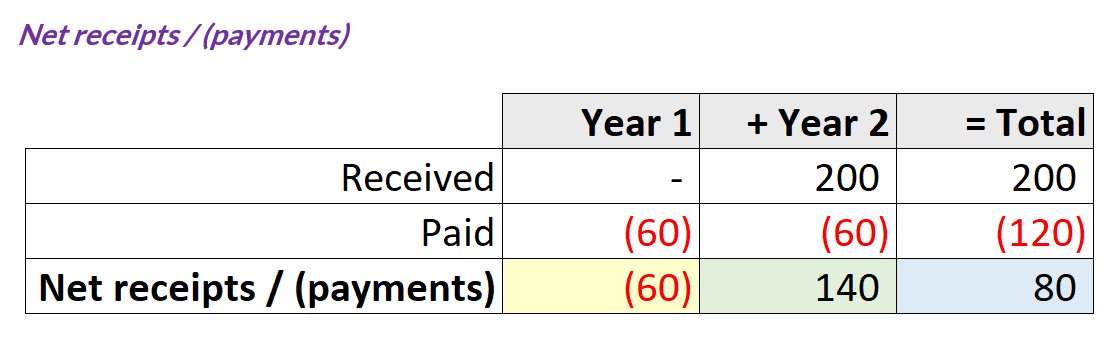

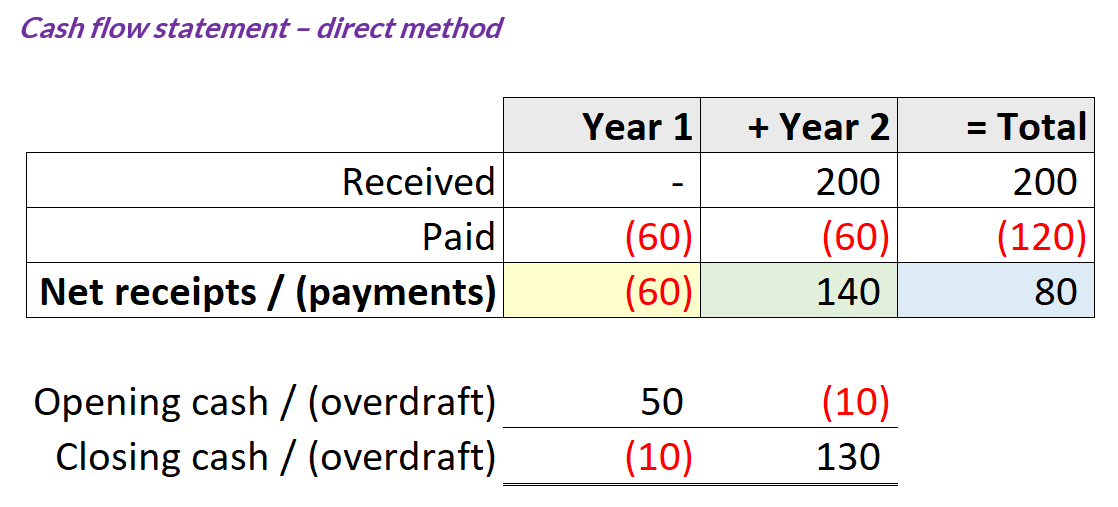

Summarising our receipts and payments, we suffer a net outflow of 60 in Year 1. But we enjoy a net inflow of 140 in Year 2.

Are we losing money?

Yes and no.

Starting with our problem. It’s our cash flow. We need to forecast our cash balances. If there are any cash shortfalls, we need to cover them.

Our opening cash balance at the start of Year 1 is 50.

There is indeed a shortfall at the end of Year 1. We need an overdraft facility, or another source of liquidity, to cover the shortfall, until we receive cash from our customer.

The table above is a forecast cash flow statement. It is presented using the “direct” method. The direct method means setting out cash received and cash paid explicitly in the statement itself.

We suffer net payments of 60 in Year 1, and enjoy net receipts of 140 in Year 2. Our net receipts for the whole two-year period are 80.

Why accruals accounting?

Considering the two-year period as a whole, we enjoy an income of 200 and our costs are 120. We earn a total net profit of 80 for the two years.

What about each individual year?

This is where accruals accounting comes in. The purpose of accruals accounting is to match:

(a) Reported income with the period in which it is earned.

(b) Reported expenditure with the income it relates to.

Accounts must show a “true and fair” view

Is it more true and fair to report the 200 income spread evenly over the two years, using an accruals adjustment? Or is it fairer to report no income in Year 1, and the whole of the 200 in Year 2?

For a monthly contract, as we have here, it’s reasonably clear cut that we should spread the income on a time basis. Other cases may not be so clear cut. Preparers of accounts will need to use judgement.

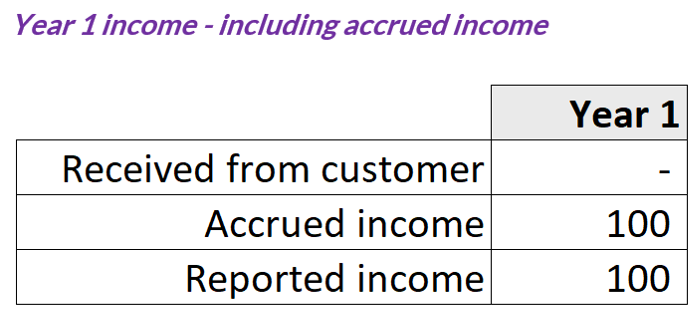

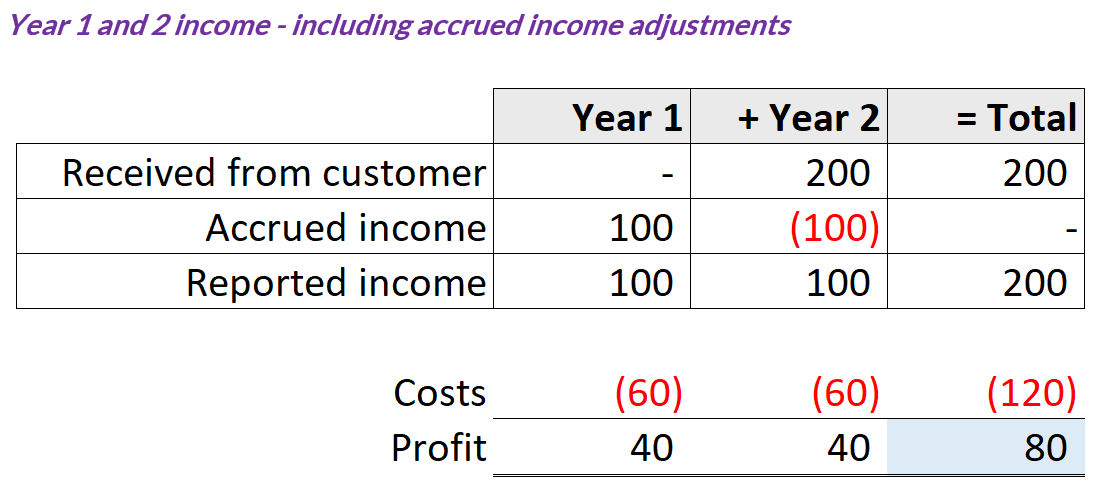

In our case, we make an accounting entry in Year 1 for “accrued income” of 100. This is a non-cash item of income added in for Year 1. There is a corresponding asset in our balance sheet.

In Year 2, we receive 200 cash. We’ve already reported 100 of income in Year 1, so now we need to reduce our reported income by 100. This is the reversal of the adjustment we made in Year 1.

Our reported profits are 40 for each separate year, a total of 80 for the two-year period.

So far, so good?

2. Alternative cash flow presentations

We built a relatively easy to understand “direct” method cash flow statement above. It shows the build-up of our outflows of 60 in Year 1, net inflows of 140 in Year 2, and net total inflows of 80.

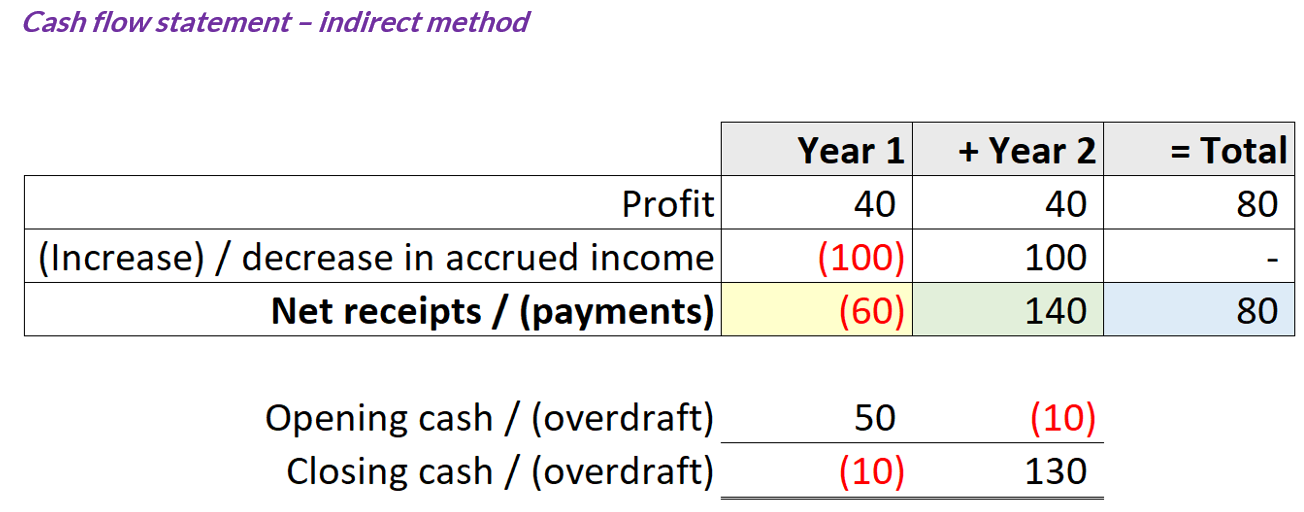

However, most organisations publish their cash flows statements using the “indirect” method of presentation. This can be confusing.

The indirect method starts with our accounting profits. It then explains the differences between our accounting profits and net cash flows, rather than building up cash flows directly from amounts received and paid. This structure is sometimes known as a “reconciliation”.

The final total cash flow figures presented are the same as we worked out using the direct method. The differences between our profits and our cash flows are the increase in accrued income in Year 1, and the decrease in Year 2.

3. Reversing out non-cash items

Why are there non-cash items in our cash flow statement?

These items are the reversal of our accrued income adjustments. Writing out our separate statements above, in combination.

Note the total of the adjustments for non-cash items (shaded pink) in each column is zero. For example in Year 1:

+100 – 100 = 0.

We added in accrued income adjustments, to work out our profit figures. To get back to our cash flows, we need to make the opposite entries, to reverse out the unwanted items. This process is sometimes known as “backing out” or “stripping out” unwanted items.

Other accruals accounting items

As we’ve seen, accrued income accelerates the accounting recognition of income into an earlier period. Similarly, accrued expenditure accelerates the recognition of costs.

Shorter-term, and more certain, accrued expenditure is often known as an “accrual”. Longer-term, and less certain, accrued expenditure is known as a “provision”.

Deferred income delays the recognition of income into a later period. Similarly, deferred expenditure delays the recognition of costs.

Shorter-term deferred expenditure is usually known as a “prepayment”. Longer-term deferred expenditure is generally known as a “capitalised” cost, or capital expenditure.

Judgment and critical view

The fair timing of income and expenditure recognition isn’t always as clear cut as in this example. Any differences in accounting treatments will directly affect reported profits or losses. While it’s necessary for preparers to exercise judgement, treasurers need to be aware of the potential subjectivity, and review the reported figures with a critical eye.

___________________

Author: Doug Williamson