You don’t need extraordinary powers to understand synthetic hedges. Let's take a look at how a simple sign convention makes synthetic forward contracts add up.

A hedge is a contract that offsets adverse changes in the value of another exposure. The hedge pays out when we’re losing money on our other exposure. So we’re hedged by the contingent cash receipt.

TWO WAYS TO HEDGE

Let’s say we’re a seller of a commodity. We have an operational exposure to its market price. If the market price falls, our revenues will suffer.

Two ways to hedge this exposure using options are to:

- Buy a put option; or

- Enter a synthetic forward contract.

1. BUY A PUT OPTION

Say we buy a put option with a strike price of $100, for a premium paid of $6. If the price of our commodity falls below the $100 strike price, perhaps to $80, we receive a cash payout based on the difference*.

In this case, the payout we receive would be:

$100 – $80 = $20

Ignoring timing differences, our net gain on the put strategy would be the payout received of $20 LESS the $6 premium paid = $14.

The receipt from the put offsets our lost revenues on selling our commodity more cheaply in the market, to provide an effective hedge.

But if the commodity price ends up equal to, or even higher than the $100 strike price of the put, there is no payout. In these cases, we’d suffer a net hedging loss of the $6 premium we’d paid, as set out in the following table. All amounts are in $.

| Put receipt / (payment) | |||

| Commodity price | 80 | 100 | 120 |

|

Receipt vs $100 (premium paid) |

20 (6) |

- (6) |

- (6) |

| Net receipt/(payment) | 14 | (6) | (6) |

Note three key features in our receipt/(payment) table (above):

(1) The option premium and the payout from the option, if any, are always in opposite directions. These are the cost and the benefit of the option contract.

(2) Our ‘mostly positive’ modelling sign convention. We’re hedging operational revenues, which are receipts. Applying the ‘mostly positive’ sign convention here designates our operational receipts – the important items there are most of – as positive numbers. Therefore, any offsetting payments will be negative (bracketed numbers).

(3) We use explicit row and column labels to support our sign convention, so we’re left in no doubt about how to combine our pluses and our minuses. Any items we’re going to be deducting are explicitly labelled with brackets, right from the start.

2. SUPER SYNTHETICS

An alternative hedge structure is a synthetic forward contract. Here we use two options in combination, to build the synthetic forward contract. We still buy a put option, exactly as we did before. But now we also sell a call option, with the same strike price as the put.

Your company, SuperHero Inc (SHI), wants to remove any price risk from its sale of a commodity, Kryptonite, which is a major revenue item.

Until recently, you have been able to fix the future price using a forward contract. The counterparty that you have normally dealt with has exited the business, however, leaving no credible market maker for a forward price. But there are option prices available for three-month expiry.

Option price data for Krytonite:

| Strike per gram | $100 |

| Three-month call premium | $7 |

| Three-month put-premium | $6 |

Describe how a synthetic forward contract appropriate for SHI can be constructed using the options quoted above.

The key to understanding this structure is that the individual results from each option simply add up. This is where investing time in our consistent sign convention and narrative labels pays off handsomely.

HEDGING WITH A SYNTHETIC FORWARD

We buy a put option for a premium payable of $6, with results as before:

| Put receipt / (payment) | |||

| Kryptonite price | 80 | 100 | 120 |

| Net receipt/(payment) | 14 | (6) | (6) |

We also sell a call option for a premium received of $7. When the Kryptonite price exceeds the call strike price of $100, we have to make a payment, for example: $120 – $100 = $20.

But we always get to keep our premium received of $7.

Following our ‘receipt/(payment)’ sign convention consistently, the net results from the call sold are:

| Call receipt / (payment) | |||

| Kryptonite price | 80 | 100 | 120 |

|

(Payment) vs $100 Premium received |

- 7 |

- 7 |

(20) 7 |

| Net receipt/(payment) | 7 | 7 | (13) |

Now it’s very easy to combine the results from each individual option. The individual results simply add up or net off. And our explicit sign convention makes it easy to get each item the right way round in the combination:

| Synthetic forward receipt / (payment) | |||

| Kryptonite price | 80 | 100 | 120 |

|

Put receipt / (payment) Call receipt / (payment) |

14 7 |

(6) 7 |

(6) (13) |

| Net receipt/(payment) | 21 | 1 | (19) |

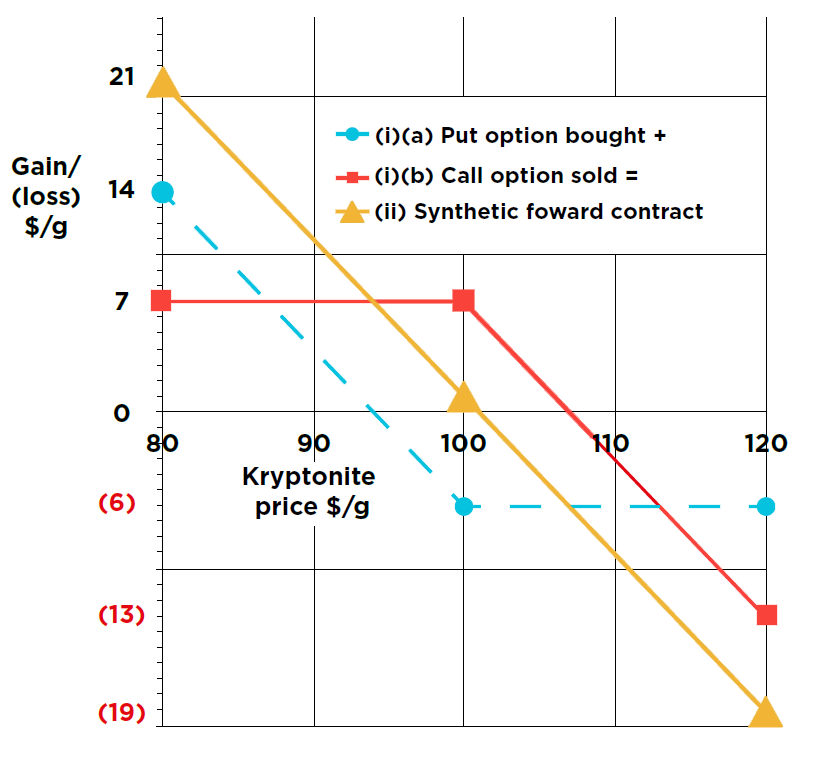

The relationships between the net gains and losses on the put (blue), the call (red) and the synthetic forward (yellow) are summarised in the following chart:

SYNTHETIC FORWARD CONTRACT TO SELL KRYPTONITE

Understanding hedge construction doesn’t need extraordinary powers. It just needs practice! Apply the ‘mostly positive’ sign convention consistently with explicit labels and you will master many challenging topics in finance.

* This is known as ‘cash settlement’. It gives exactly the same result as physical sale and delivery of the commodity, but saves transport and storage.

____________________

Author: Doug Williamson

Source: The Treasurer magazine