Many corporates are holding a lot of cash. The different ways tiered interest rates are applied makes a big difference to total interest earnings.

Tiered interest is credited at higher rates on larger balances. Calculations can either be (i) stepped or (ii) banded. Banded interest is better for customers, because the higher rates are applied to the entire balance.

Most corporate groups also have large numbers of bank accounts. Pooling balances for interest calculations, where possible, will also give significantly better results for customers.

GROUP TIERS

Let's develop a simple example...

Holdco plc has one subsidiary, Sub A. Both companies have accounts with the same bank. Interest is currently applied on a stepped basis on the individual average surplus balances of £390,000 and £510,000.

| Amount (£000) | Interest rate per annum |

| Up to 250 | 0.1% |

| 250 - 500 | 0.2% |

| 500 - 1,000 | 0.5% |

| 1,000 - 2,000 | 0.9% |

Let's look at how to calculate the annual benefit to the group of introducing a notional pooling arrangement where interest is applied on a branded basis.

THE SIMPLEST CALCULATION GIVES US THE BEST RESULT

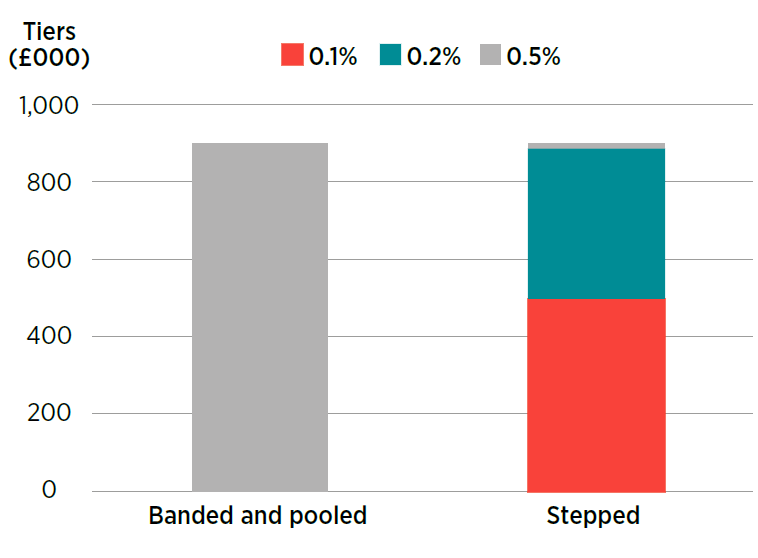

Pooling and banding, applied together, results in the highest interest earnings.

Pooling the balances of £390,000 and £510,000 gives a total balance of £900,000. This falls into the 0.5% per annum interest tier.

Banded interest means applying the 0.5% to the entire £900,000.

Annual interest enjoyed is:

900,000 x 0.5%

= £4,500

Our entire group balances of £900,000 are all earning interest at this beneficial rate.

COMPLEX AND WORSE

Without the banding and pooling arrangements, the deal is worse for the customer in two ways:

- Credit interest is applied in steps (increments) rather than banded

- Accounts are treated individually, rather than being pooled

STEPPED INTEREST

Stepped interest means only the incremental amounts in higher tiers earn interest at the higher rates. Let's consider Holdco (H) on its own.

| Tier (£000) | H balance (£000) |

| Up to 250 | 250 |

| 250 - 500 | 140 |

| 500 - 1,000 | - |

| 390 |

Only £140,000 earns at the better 0.2% rate (coloured green). Most of the balance (£250,000) goes into the worst-earning tier at 0.1% (coloured red).

DIVIDED WE FALL

Now let's bring back Sub A. Without pooling, the stepped balances in A's account are treated similarly to H's. But A is calculated individually, ignoring the account held by H.

| Tier (£000) | H (£000) | A (£000) | Total (£000) | Rate | Interest earnings (£) |

| Up to 250 | 250 | 250 | 500 | 0.1% | 500 |

| 250 - 500 | 140 | 250 | 390 | 0.2% | 780 |

| 500 - 1,000 | - | 10 | 10 | 0.5% | 50 |

| 390 | 510 | 900 | 1,330 |

Interest-earning power is substantially reduced. Most of the total group balances now earn at the very worst rate of just 0.1%.

Only a small increment is earning interest at the favourable rate of 0.5%, compared with the entire £900,000 under banding and pooling. This results in much lower interest earnings – just £1,330.

THE BENEFIT OF POOLING AND BANDING

The annual benefit of pooling and banding is £3,170. This is the difference between the £4,500 earned under the better arrangements, and £1,330 under the worse ones. This kind of calculation is important in practice - getting quick and confident at them needs your focused effort.

ONE MORE COMPANY

Let's introduce one more group company. Say our new company has a surplus cash balance of £245,000.

What’s the annual benefit of pooling and banding now?

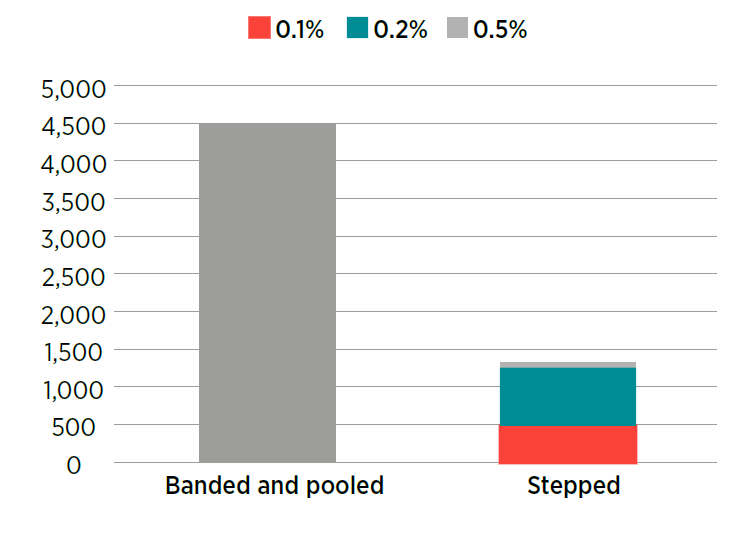

BANDED AND POOLED

Total pooled balances are now:

0.39m + 0.51m + 0.245m

= £1.145m

This total £1.145m falls into the tier above £1m, and the interest rate of 0.9%.

Banding means the 0.9% applies to the entire £1.145m.

So, interest earnings are:

1,145,000 x 0.9%

= £10,305

INDIVIDUAL AND STEPPED

Now, turning to the individual and stepped arrangement – on this basis, the additional £245,000 is all in the very lowest tier – below £250,000 – earning just 0.1%.

Interest on this incremental amount is:

245,000 x 0.1%

= £245

Added to the £1,330 we calculated before, total interest earnings

under the individual and stepped arrangements are now:

1,330 + 245

= £1,575

Banded boosts earning power of £900k surpluses

A big step down: interest earnings £1,330

MORE REWARDS

The total benefit of pooling and banding becomes £8,730. Again, this is the difference between the handsome £10,305 now enjoyed under pooling and banding, and the rather derisory £1,575 without them.

Well worth investing a little time and sweat to understand. Having understood, make sure you always negotiate with your bank for the most favourable basis. Banded will always be better. Notional pooling will also be better, where permitted by local regulations and offered by the bank.

____________________

Author: Doug Williamson

Source: The Treasurer magazine

Want to learn more about treasury and cash management?

Choose from:

• eLearning courses: 45-90 minutes to complete, available online 24/7.

• Training courses: live skills-based training sessions.

• Treasury and Cash Management qualifications: internationally recognised courses from entry to master level.

All our courses will provide you with valuable knowledge as well as easy-to-share digital credentials to demonstrate your learning achievements.