Published: 31 March 2025

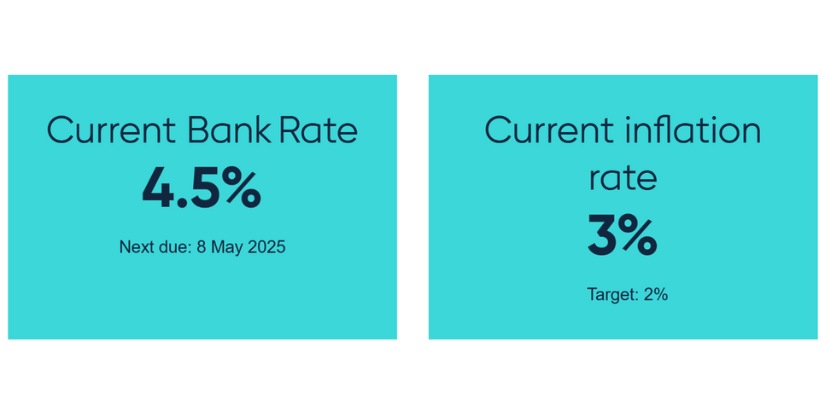

The UK’s official Bank Rate is 4.5% at the time of writing in money terms while CPI inflation is 3%. What is the real terms bank rate? Real terms figures are ones adjusted to remove the effects of inflation. For example, real interest rates are money terms rates, adjusted downward for inflation (when inflation is positive). It’s fundamentally important for treasurers to know which figures are which, and how to reconcile and explain them.

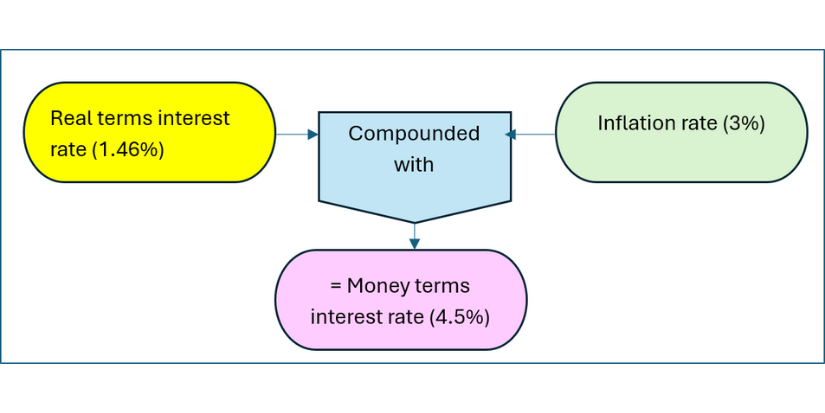

In this case, the real terms rate is roughly 4.5% - 3% = 1.5%. More strictly, it’s 1.045 / 1.03 – 1 = 1.46%. The second, stricter, calculation reflects the compounding together of inflation and the real terms rate to form the money terms figure. They don’t just simply add up

Compounding up interest rates & growth rates

Let’s check the compounding calculation.

Money terms rate = (1 + real rate) x (1 + inflation rate) – 1

= ( 1.0146 x 1.03 ) – 1

= 0.045

= 4.5% money terms rate, OK.

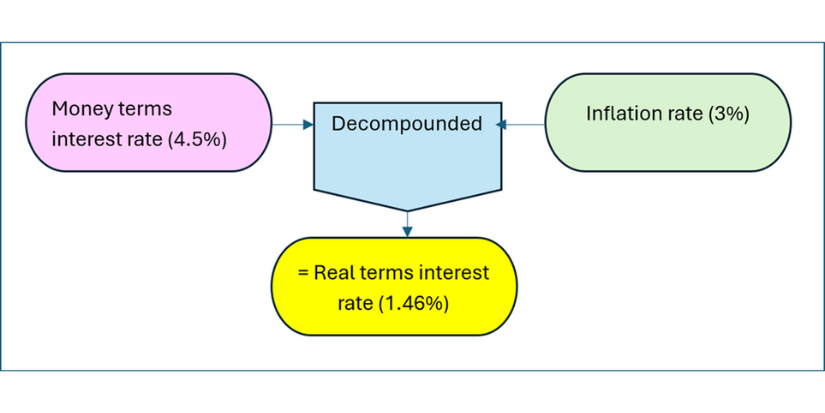

And decompounding for the real rate

Let’s confirm this decompounding calculation.

Real terms rate = (1 + money terms rate) / (1 + inflation rate) – 1

= ( 1.045 / 1.03 ) – 1

= 0.0146

= 1.46% real terms rate, as before.

The same quoting and conversion principles apply to any growth rates, for example GDP growth or decline – see below – as well as to interest rates.

Why this matters for treasurers

This is important for us as treasurers because real terms and money terms figures are so widely quoted jumbled up. For example, Gross Domestic Product (GDP) growth is quoted in real terms, while most market yields and interest rates are quoted in money terms.

It’s fundamentally important for treasurers to know which figures are which, and how to reconcile and explain them.

Can real terms rates be negative?

Yes. When inflation is equal to the money terms (or nominal) rate, the real rate is zero. When inflation rates exceed the money terms rate, the real terms rate will be negative.

What is CPI inflation?

Great question! CPI inflation is the inflation measure that the UK’s Bank of England is mandated to monitor and manage as a priority. In a UK context, CPI means Consumer Prices Index. It’s calculated as the change from month to month in the prices of a standard basket of consumer goods and services.

Not to be confused with the US Consumer Price Index, also abbreviated as CPI. There are many different inflation measures, designed and calculated for different retail and business purposes. Some of the ones more often encountered in treasury-relevant contexts are set out below.

|

Retail |

Business |

|

|

How do central banks manage inflation?

A key tool that central banks use to manage inflation is the official Bank Rate, or its equivalent central bank rate. For example, the Bank of England determines and announces any changes in the UK’s official bank rate 8 times a year.

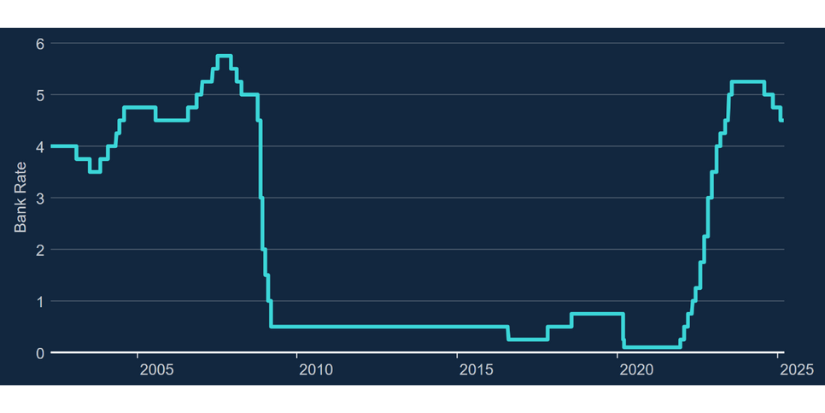

UK Official Bank Rate (%) 2005 - 2025

Source – Bank of England – March 2025

Subject to time lags and other factors, there is an inverse relationship between the official bank rate and inflation rates. When the central bank increases the official bank rate, it makes all borrowing more expensive, cools demand throughout the economy, and creates downward pressure on inflation and GDP. On the other hand, cutting the central bank rate makes borrowing cheaper, boosts demand and GDP, but can also stimulate excessive inflation.

Central bank rates are an enormously important driver of corporate organisations’ cost of borrowing. For this reason treasurers monitor the central banks’ actions and announcements on interest rates very closely.

The Bank of England’s current mandate is to keep inflation close to +2% per annum.

Source – Bank of England – March 2025

Can inflation be negative?

It certainly can. Negative inflation is known as deflation. Central banks and governments work strenuously to avoid deflation, as well as avoiding excessively high inflation.

What’s wrong with deflation?

The problem with deflation is that if provides a strong incentive for households and businesses to defer expenditure. In a situation where prices generally are falling, it would normally be attractive to delay spending where possible, as the same goods and services are likely to be available more cheaply in the near future.

In turn, this cools total demand in the economy, leading to further price cutting by producers, and a potential recession or depression in the wider economy.

By contrast, a small positive rate of inflation can provide an incentive to accelerate expenditure, providing a boost to economic activity. This is why the inflation target is a small and stable positive rate of inflation.

Author: Doug Williamson FCT

Other resources

Index - the Treasurer’s Wiki

https://wiki.treasurers.org/wiki/Index

Indexation - the Treasurer’s Wiki https://wiki.treasurers.org/wiki/Indexation

Inflation - the Treasurer’s Wiki

https://wiki.treasurers.org/wiki/Inflation

Stagflation - the Treasurer’s Wiki

https://wiki.treasurers.org/wiki/Stagflation

Real - the Treasurer’s Wiki

https://wiki.treasurers.org/wiki/Real

Real terms - the Treasurer’s Wiki