“Real” sounds reassuringly solid and straightforward, doesn’t it? Sadly, like many terms in treasury, it’s potentially ambiguous.

This means we need to:

- Clarify the different meanings of “real”, in different contexts.

- Ask, when the meaning isn’t clear.

- Use the term “real” carefully and sparingly, to avoid confusion.

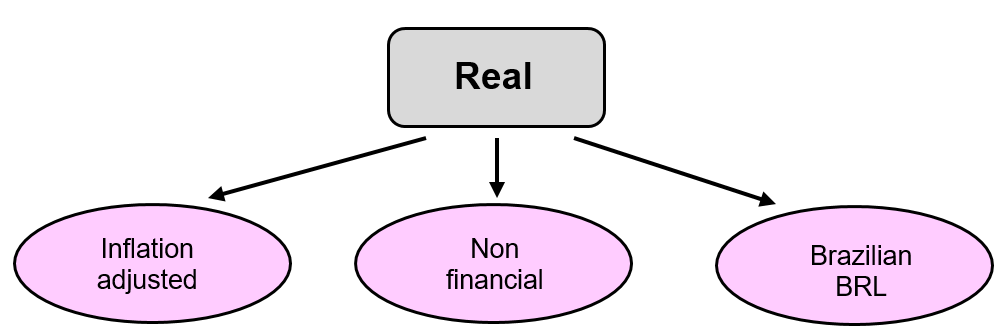

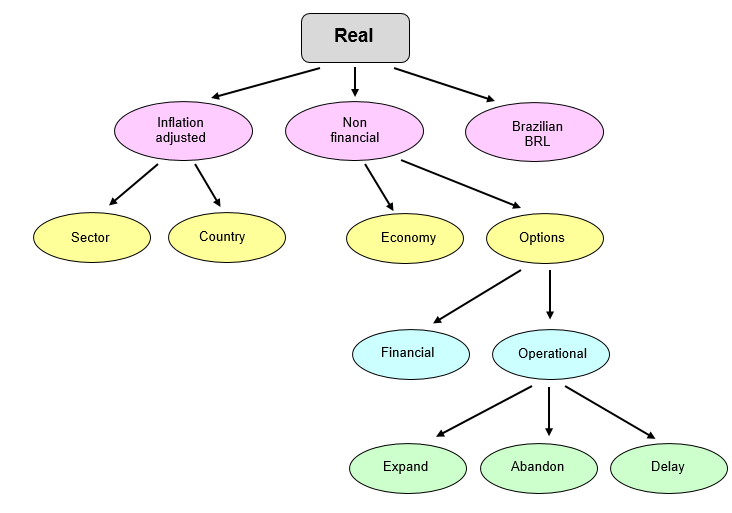

Real can mean inflation-adjusted, non-financial, or the currency of Brazil.

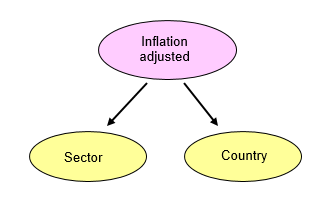

Inflation adjustment: real terms

Real terms figures are the ones that have been adjusted for inflation, to enable comparisons. Let’s say our Turkish subsidiary’s revenues were TRY 100m last year. This year, local management is forecasting TRY 105m. It sounds like sales are growing at 5%. But are they? The estimated general inflation in Turkey is around 10%, and inflation in our sector is closer to 20%.

A “real terms” comparison may shed some light. Assuming the forecast of TRY 105m has been stated in conventional nominal (money) terms, the apparent 5% growth in revenue is entirely due to inflation. This means in real terms, revenue is actually forecast to decline. If the relevant inflation rate is 10%, real terms revenues are declining at about 5%. Applying a 20% inflation adjustment, real terms revenues are falling even faster. We need to investigate.

On the other hand, local management may have forgotten to consider inflation when making this forecast. (Such errors are more common than you might expect.) In which case, the TRY 105m may need to be increased by inflation, to work out our revenue in money terms.

But what if our sales are mostly exports to other countries? Which countries’ inflation rates are the most relevant? Are general inflation rates, or sector rates, likely to be more appropriate? Do we need to factor in expected changes in foreign exchange rates? We need to ask! Having found out the answers, add notes and commentary to the forecast data, for the benefit of other users.

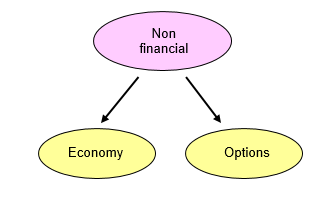

Non-financial

Another meaning of “real” is non-financial. Examples include the real economy and real options.

Non-financial: real economy

The real economy is the part of the total economy that excludes financial services and financial markets. The Association of Corporate Treasurers represents the interests of the real economy through its educational and other activities. It also works with other bodies, including the Bank of England.

... the actions that the Bank [of England] will take to help UK businesses and households bridge across the likely economic disruption [include] an SME Term Funding Scheme, to help reinforce the transmission of the reduction in Bank Rate to the real economy.

UK annual budget speech, 2020

Non-financial: real options

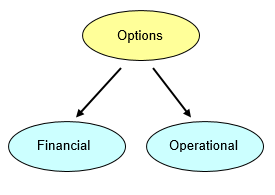

Options are valuable rights to exercise potentially beneficial choices. The uniquely attractive feature of options is that we’re not obliged to exercise them. Financial options are rights to buy or sell things, generally at pre-determined fixed prices that may turn out to be favourable.

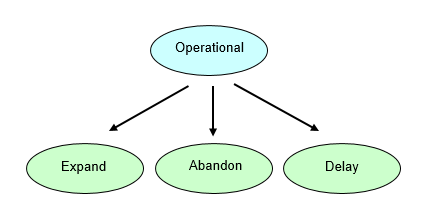

Operational options, more often known as real options, are valuable rights to make operational choices.

Such real options to expand, abandon, delay or pivot operations can be the most valuable part of a project. Real options are also enormously important in your career. The more value you have learned to add through your education and experience, and the more people who know and trust you, the greater the number and worth of the valuable career options you will enjoy.

Brazilian real: BRL

Real is also the currency of Brazil. It’s pronounced differently from the “real” concepts discussed above, with two syllables rather than one. However, that’s not so useful when it’s in writing! To avoid any possible confusion with currencies, use the unique ISO currency codes – such as BRL and TRY – instead.

Don’t over-use new words

Thank you for investing your time to learn some of the important different treasury meanings of “real”. Personally, when I learn a new word, I’m often tempted to over-use it! Try to use more specific terms for the context, for example inflation-adjusted, non-financial or BRL.

Real – family tree

___________________

Author: Doug Williamson