FX swaps are a powerful short-term currency management tool. FX swaps can sometimes achieve better results than two simpler short-term instruments that treasurers use, namely spot and forward FX contracts.

They are very important for treasurers to understand and remembering their two legs is a great place to start!

TWO EXCHANGES

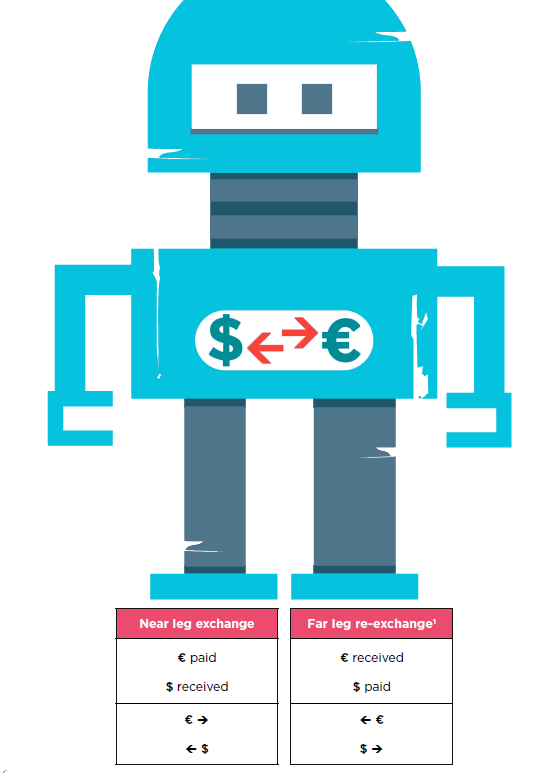

An FX swap is a composite short-dated contract, consisting of two exchanges, sometimes known as legs.

(1) An initial exchange of two currencies on a near leg date, commonly spot.

(2) A later reverse-direction exchange of the same two currencies, on a far leg date.

For example, euro might be paid and dollars received in the near leg, with euro received and dollars paid in the far leg.

DRAW THEM

A drawing is an effective way of explaining the two legs of FX swaps to colleagues:

WHAT'S THE DIFFERENCE?

FX swaps involve two exchanges, at different times. Spot and forward deals are for a single exchange only.

| Number of exchanges | When | |

| Spot | 1 | Spot date |

| Forward | 1 | Forward date |

| FX swap | 2 | Near leg date and far leg date |

USES

FX swaps have three main uses for corporate treasurers:

- Offset temporary deficits and surpluses in different currencies.

- Combine temporary surpluses in different currencies, to improve short-term investment income.

- Roll forward FX contracts on to a later forward date, for example, when a hedged currency receipt is delayed.

WHY NOT USE TWO SIMPLER DEALS?

Isn’t an FX swap exactly the same as selling a currency at spot, then buying it back again later, with a forward contract?

Well, that would be almost the same, but not exactly. The potential difference, and potential benefit, is the pricing of the composite FX swap.

However, not all banks will necessarily give us this favourable pricing, so in practice we may need to shop around, or negotiate.

WHAT'S THE PRICE?

Let’s look more closely at pricing. The initial (near leg) exchange and the later (far leg) re-exchange are at two different exchange rates.

The difference between the near and far leg exchange rates reflects:

- Any difference in interbank interest rates between the two currencies; and

- The bank’s profit for providing the service.

BANK'S PROFIT

The bank doesn’t need so much profit on the composite FX swap, because technically the FX swap is only an interest rate position, with no FX risk for the bank.

MISCONCEPTIONS TO AVOID

Two things to notice:

- The two-way nature of the FX swap exchanges; and

- The diffentent amounts of currency in the re-exchange.

1. NOT JUST A TRANSFER

Both of the exchanges in the FX swap are the payment of one currency, and the receipt of another. The currency received may then be transferred, for example, within a group of companies. But the FX swap itself is not a simple transfer of funds.

2. RE-EXCHANGE AMOUNTS ARE SLIGHTLY DIFFERENT

The amounts of currency in the far leg are normally slightly different from those in the near leg exchange, reflecting both:

- The difference between the near and far leg exchange rates, in all cases; and

- Currency interest earnings, in some cases.

NET BENEFIT

Say a group has a temporary euro surplus, and it can earn significantly higher rates of interest in US dollars than in euro. This group could improve its net interest earnings by €8,000, by switching the euro surplus into dollars for a temporary period, using an FX swap.

However, using this FX swap would also result in an exchange loss of €6,000.

The net benefit of using the FX swap would be:

€8,000 – €6,000

= €2,000

Overall, it’s worth using the FX swap in these circumstances.

HOW DOES THAT WORK?

Efficient market pricing says the interest benefit should be exactly matched and eliminated by the exchange loss. So, how did we achieve a net benefit of €2,000?

It’s essentially a cost-saving exercise.

Whenever a customer deals in the market, they get the worse side of a two-way rate, incurring costs. By using an FX swap, we can sometimes save part of these costs to achieve a better net result.

CAPITAL MARKET SWAPS

Some people confuse FX swaps with longer-dated swaps. We need to understand the differences between FX swaps and two other important kinds of swap.

| Full name | |

| FX SWAP | Foreign exchange swap |

| IRS | Interest rate swap |

| CCIRS | Cross-currency interest rate swap |

IRSs and CCIRSs are longer-term risk management tools, sometimes known collectively as ‘capital market swaps’. CCIRSs are also sometimes known as ‘currency swaps’.

DIFFERENCES BETWEEN SWAPS

| DEALS WITH | MATURITIES | EXCHANGES OR SETTLEMENTS | |

| FX SWAPS | FX | Short term | Exactly 2 |

| IRS | Interest rates | Longer term | Multiple, usually more than 2 |

| CCIRS | FX and interest rates |

MIND YOUR LANGUAGE

Talking too simply about 'a swap' can be ambiguous. It's better to use different names for the different kinds of swaps, like 'FX swaps', 'IRS', 'CCIRS', or their full names. This makes it easier to discuss different kinds of swap with other people, without mixing them up.

____________________

Author: Doug Williamson

Contributors: With many thanks to Paul Cowdell for his valued suggestions.

Source: The Treasurer magazine

1 Amounts in the re-exchange may be slightly greater, so our far leg is drawn larger.

Want to learn more about foreign exchange?

Choose from:

• eLearning courses: 45-90 minutes to complete, available online 24/7.

• Training courses: live skills-based training sessions.

• Treasury and Cash Management qualifications: internationally recognised courses from entry to master level.

All our courses will provide you with valuable knowledge as well as easy-to-share digital credentials to demonstrate your learning achievements.